Overview of the Structure of Medicine Consumption: Focus On Proton Pump Inhibitors

Oleksandr Shmatenko*, Vitaly Osodlo, Halyna Osodlo, Dmytro Drozdov, Oksana Bielozorova

|

|

Ukrainian Military Medical Academy, Kyiv, Ukraine. |

Abstract

The authors conducted a comparative study of the structure of consumption of proton pump inhibitors presented in the pharmaceutical market of Ukraine, with an emphasis on the domestic manufacturer. The largest relative increase in esomeprazole in the 1st quarter of 2020 compared to the same period last year is shown.

Keywords: medicines, proton pump inhibitors, esomeprazole, marketing analysis.

Introduction

The topic of health has always been important for human [1-3]. The ever-growing and complicated variety of medications and non-adherence to prescribed medications have compelled the pharmacist’s position to evolve into a more patient-centered strategy [4]. Health-promoting schools (HPS) program has been developed by World Health Organization (WHO) over the last decade and is being implemented globally [5]. Improving the medical supply of medical institutions following the real needs of the medical-diagnostic process and taking into account the current level of development of medical and pharmaceutical science and practice remains a significant social, economic and medical problem [6]. Digestive diseases occupy the third place in the structure of morbidity of servicemen, and the leading positions are occupied by acid-dependent diseases (ACD), which are characterized by an aggressive course during the intensification of hostilities [7, 8].

Proton pump inhibitors (PPIs) are recognized as the most effective antisecretory medicines for the treatment of patients with CKD. By blocking the final phase of hydrogen proton secretion, PPIs are the most effective acid-inhibiting agents. Their effectiveness has been proven in controlled multicenter studies, and the molecular mechanism of action causes a low frequency of side effects. However, different classes of PPIs differ in their pharmacokinetics, pharmacodynamic properties, clinical effect, and pharmacoeconomic indicators [9].

Our study aimed to study the structure of consumption of proton pump inhibitors presented in the pharmaceutical market of Ukraine.

Materials and methods of research

The materials of the study were the data of the analytical system "Pharm Explorer of Proxima Research Ukraine" for the 1st quarter of 2020 [10].

System-review, statistical, bibliographic, and marketing methods were used to study medicines.

Research results and their discussion:

According to the analytical system of Pharm Explorer of Proxima Research Ukraine, in total for the 1st quarter of 2020, Ukrainians consumed more than 329 million packages of medicines. The relative increase compared to the 1st quarter of 2019 was 14.88%. The leader in consumption was the category of drugs that affect the digestive system and metabolism with an increase of 10.78%.

In a detailed analysis of the consumption structure of the group of medicines that affect the digestive system, it should be noted (Table 1) that medicines for the treatment of diseases associated with acidity are not only among the three most in-demand with a share in the consumption structure of 13.46% but also show a 9.05% increase over the previous year. Given that the group of vitamins and antidiarrheals that topped the ranking includes a large number of over-the-counter drugs, there is reason to believe that a large proportion of the population suffers from CKD, and the search for pharmacologically advantageous treatment regimens is an urgent problem today.

Table 1: Structure of medicines consumption affecting the digestive system and metabolism in the packaging (Ukraine, Q1 2020)

|

ATC 2 |

Consumption, unitary enterprise |

Increase to the same period last year (%) |

Share in consumption structure (%) |

|

In general |

59,985.73 |

10.78% |

100.00% |

|

1.11 (A11) Vitamins |

11,464.58 |

26.98% |

19.11% |

|

1.7 (A07) Antidiarrheal, intestinal anti-inflammatory and anti-infective drugs |

8,221.67 |

-3.16% |

13.71% |

|

1.2 (A02) Medicines for the treatment of diseases associated with acidity disorders |

8,074.56 |

9.05% |

13.46% |

|

1.3 (A03) Medicines for the treatment of functional disorders of the gastrointestinal disorders |

7,522.22 |

14.47% |

12.54% |

|

1.10 (A10) Medicines for the treatment of diabetes |

4,731.03 |

37.31% |

7.89% |

|

1.9 (A09) Medicines that promote digestion, including enzymes |

3,978.14 |

3.93% |

6.63% |

|

1.5 (A05) Medicines for the treatment of liver and biliary tract diseases |

3,737.63 |

-2.96% |

6.23% |

|

1.6 (A06) Laxatives |

3,684.53 |

2.07% |

6.14% |

|

1.1 (A01) Dental medicines |

2,779.63 |

32.00% |

4.63% |

|

1.16 (A16) Other medicines for the treatment of diseases of the gastrointestinal tract and metabolic disorders |

2,551.40 |

-0.67% |

4.25% |

|

1.12 (A12) Mineral supplements |

2,039.50 |

-3.96% |

3.40% |

|

1.4 (A04) Antiemetics and medicines that eliminate nausea |

442.72 |

15.19% |

0.74% |

|

1.13 (A13) General tonics |

382.65 |

-0.53% |

0.64% |

|

1.15 (A15) Appetite stimulants |

185.79 |

5.68% |

0.31% |

|

1.14 (A14) Anabolic agents for systemic use |

183.82 |

6.70% |

0.31% |

|

1.8 (A08) Medicines for the treatment of obesity, with the exception of dietary products |

5.87 |

-5.91% |

0.01% |

Medicines for the treatment of peptic ulcer and gastroesophageal reflux disease (GERD) confidently dominate in the group of medicines for the treatment of acid-dependent diseases. Their share was 83.98%, and the growth rate was 10.69% compared to the same period last year (Table 2).

Table 2: The structure of medicines consumption for the treatment of diseases associated with acidity disorders in the packaging (Ukraine, Q1 2020)

|

ATC 3 |

Consumption, unitary enterprise |

Increase to the same period last year (%) |

Share in consumption structure (%) |

|

In general |

8,074.56 |

9.05% |

100.00% |

|

Medicines for the treatment of peptic ulcer and GERD |

6,781.30 |

10.69% |

83.98% |

|

Antacids |

761.54 |

2.67% |

9.43% |

|

Other medicines for the treatment of acid-dependent diseases |

531.72 |

-0.87% |

6.59% |

Analysis of a group of medicines for the treatment of peptic ulcer and GERD revealed some characteristic features. Draws attention to the dominance of PPIs in the structure of consumption, which may indicate a growing demand for this group both among consumers and among professionals. In contrast to H2-histamine receptor blockers, they show a positive increase of more than 20% compared to the same period last year (Table 3).

Table 3: The structure of medicines consumption for the treatment of peptic ulcer and GERD, in packages (Ukraine, Q1 2020)

|

ATC 4 |

Consumption, unitary enterprise |

Increase to the same period last year (%) |

Share in consumption structure (%) |

|

In general |

6,781.30 |

10.69% |

100.00% |

|

Proton pump inhibitors |

3,725.27 |

20.34% |

54.93% |

|

H2-histamine receptor antagonists |

2,607.17 |

-1.30% |

38.45% |

|

Other remedies for the treatment of acid-dependent diseases |

421.20 |

15.15% |

6.21% |

|

Combinations for eradication of Helicobacter pylori |

27.65 |

16.36% |

0.41% |

As the group of proton pump inhibitors confidently predominates in the structure of consumption (PPI group also became the leader in the structure of appointments among family physicians and gastroenterologists, the analysis data will be given below), we will consider it in more detail.

First, all modern PPI molecules (omeprazole, lansoprazole, pantoprazole, rabeprazole) are available on the Ukrainian pharmaceutical market, including isomeric compounds (esomeprazole, dexlansoprazole) and combinations of PPIs with prokinetics. According to the data of the analytical system Pharm Explorer of Proxima Research Ukraine, omeprazole, pantoprazole, and esomeprazole are in the lead in the structure of PPI consumption in packaging, according to international non-proprietary names (INN) in the first quarter of 2020 (Table 4).

Secondly, among the 10 most successful pharmaceutical companies in this segment, 5 domestic manufacturers should be noted at once. According to the analytical system of Pharm Explorer of Proxima Research Ukraine, 5 Ukrainian pharmaceutical companies are leaders in the structure of PPI consumption in packaging, under international non-proprietary names: PJSC "Farmak", Corporation "Arterium", LLC "Kusum Pharm", PJSC "Darnytsia" and Univers "Pro-Pharma" (Table 5).

Table 4: Structure of PPI consumption in packages, INN, (Ukraine, Q1 2020)

|

INN |

Consumption, unitary enterprise |

Increase to the same period last year (%) |

Share in consumption structure (%) |

|

In general |

3,725.27 |

20.34% |

100.00% |

|

01. OMEPRAZOLUM |

2,070.35 |

14.22% |

55.58% |

|

02. PANTOPRAZOLUM |

1,199.22 |

28.04% |

32.19% |

|

03. ESOMEPRAZOLUM |

225.01 |

55.93% |

6.04% |

|

04. RABEPRAZOLUM |

146.19 |

24.32% |

3.92% |

|

05. DOMPERIDONUM+OMEPRAZOLUM |

42.40 |

-11.13% |

1.14% |

|

06. LANSOPRAZOLUM |

21.06 |

-4.11% |

0.57% |

|

07. DEXLANSOPRAZOLUM |

21.03 |

42.42% |

0.56% |

Table 5: Structure of PPI consumption, in packages, by marketing organizations (Ukraine, 1st quarter of 2020)

|

Market Org |

Consumption, unitary enterprise |

Increase to the same period last year (%) |

Share in consumption structure (%) |

|

Total |

3,725.27 |

20.34% |

100.00% |

|

01. Dr. Reddy`s Laboratories Ltd (India) |

732.07 |

19.12% |

19.65% |

|

02. Farmak OJSC (Ukraine, Kiev) |

487.26 |

68.15% |

13.08% |

|

03. KRKA (Slovenia) |

462.03 |

34.79% |

12.40% |

|

04. Arterium Corporation OJSC (Ukraine, Kiev) |

303.19 |

-18.53% |

8.14% |

|

05. Teva (Israel) |

263.89 |

21.33% |

7.08% |

|

06. Kusum Pharm LLC (Ukraine, Kiev) |

229.34 |

18.93% |

6.16% |

|

07. Darnitsa PrJSC (Ukraine, Kiev) |

228.15 |

16.41% |

6.12% |

|

08. Universal Agency PRO-PHARMA LLC (Ukraine, Kiev) |

143.97 |

18.59% |

3.86% |

|

09. Takeda (Japan) |

122.06 |

9.52% |

3.28% |

|

10. World Medicine (Great Britain) |

118.99 |

57.89% |

3.19% |

Third, among the wide variety of PPI compounds, the largest relative increase is shown by the esomeprazole molecule - 56% at once compared to the same period last year. Such growth rates indicate that professional interest in this molecule is growing. This also suggests that the therapeutic benefits of esomeprazole are encouraging more physicians and their patients to use it. Fourth, in the structure of esomeprazole consumption in terms of specific forms of different brands available on the domestic market, it should be noted some characteristics, namely: the undisputed leader in consumption is the oral form at a dose of 40 mg; the number of tablets in the package is usually 14 pcs. Among domestic drugs in this segment, the greatest demand is for drugs under the trade name Ezonex PJSC "Farmak", all 3 forms of which show positive dynamics. The largest share in the structure of consumption is occupied by the solution for infusion - 22.42%, and the highest growth rate - tablet form at a dose of 40 mg, immediately 259% compared to the same period last year (Table 6).

Given the significant representation in the structure of consumption of both oral and infusion forms of esomeprazole, there is reason to believe the successful use of the molecule in outpatient practice and the hospital.

Table 6: The structure of consumption of esomeprazole medicines in packages by dosage forms and trade names (Ukraine, Q1 2020)

|

SKU |

Consumption, unitary enterprise |

Increase to the same period last year (%) |

Share in consumption structure (%) |

|

In general |

225.01 |

55.93% |

100.00% |

|

000001. EZOLONG-40, Organosyn Life Sciences (India), tabs coated w/film 40 mg blister in box, #14 |

80.84 |

19.79% |

35.93% |

|

000002. ESONEXA, Farmak OJSC (Ukraine, Kiev), lyoph. f/sol. f/inf. and in. 40 mg flask, #1 |

50.44 |

11.50% |

22.42% |

|

000003. EZOLONG-20, Organosyn Life Sciences (India), tabs coated w/film 20 mg blister in box, #14 |

33.50 |

363.53% |

14.89% |

|

000004. ESONEXA, Farmak OJSC (Ukraine, Kiev), tabs intest. solub. 40 mg blister, #14 |

14.80 |

258.76% |

6.58% |

|

000005. NEXIUM®, AstraZeneca (Great Britain), tabs coated w/film 40 mg blister, #14 |

14.69 |

137.54% |

6.53% |

|

000006. NEXIUM®, AstraZeneca (Great Britain), tabs coated w/film 20 mg blister, #14 |

8.23 |

104.88% |

3.66% |

|

000007. ESONEXA, Farmak OJSC (Ukraine, Kiev), tabs intest. solub. 20 mg blister, #14 |

6.55 |

52.71% |

2.91% |

|

000008. PEMOZAR, SUN (India), powd.fr-dr., f/sol. f/in. 40 mg flask, #1 |

5.12 |

218.02% |

2.28% |

|

000009. NEXIUM®, AstraZeneca (Great Britain), tabs coated w/film 20 mg blister, #7 |

4.56 |

195.12% |

2.03% |

|

000010. ESOMER, Perrery Farmaceutici (Italy), tablets gastroresistant 40 mg blister, #28 |

1.43 |

192.31% |

0.63% |

|

000011. EZOLONG®, Organosyn Life Sciences (India), powder for solution for inject 40 mg flask, #10 |

1.37 |

|

0.61% |

|

000012. NEXIUM®, AstraZeneca (Great Britain), powd.f/pr. sol. f/inj. & inf. 40 mg flask, #10 |

1.26 |

18.32% |

0.56% |

|

000013. PEMOZAR, SUN (India), tablets gastroresistant 40 mg blister, #14 |

1.13 |

231.15% |

0.50% |

|

000014. PEMOZAR, SUN (India), tablets gastroresistant 20 mg blister, #14 |

0.56 |

236.33% |

0.25% |

|

000015. EMANERA, KRKA (Slovenia), caps. intest.-soluble 20 mg blister, #28 |

0.21 |

-25.93% |

0.09% |

|

000016. EMANERA, KRKA (Slovenia), caps. intest.-soluble 40 mg blister, #28 |

0.19 |

57.77% |

0.08% |

|

000017. EMANERA, KRKA (Slovenia), caps. intest.-soluble 40 mg blister, #14 |

0.05 |

53.18% |

0.02% |

|

000018. EMANERA, KRKA (Slovenia), caps. intest.-soluble 20 mg blister, #14 |

0.05 |

214.64% |

0.02% |

|

000019. ESOMEPRAZOLE-PHARMEX, Zdoroviye LLC (Ukraine, Kharkiv), lyophil. f/inject or infusions 40 mg flask, #1 |

0.01 |

-66.07% |

0.01% |

|

000020. ESOMEALOX, Sanofi (France), caps. solid, intest.-soluble 40 mg blister, #14 |

0.00 |

-87.03% |

0.00% |

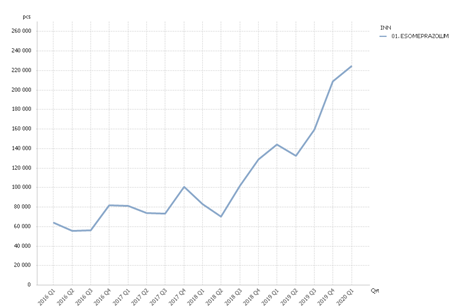

Estimation of the dynamics of demand for the esomeprazole molecule (Fig. 1) indicates an increase in interest in the compound in the last 2 years. Undoubtedly, this reflects the cumulative positive experience gained by domestic experts, on the one hand, and the rapidly growing positive evidence base for this molecule in Ukraine and the world.

Figure 1: Dynamics of esomeprazole consumption in packages (Ukraine, Q1 2016 - Q1 2020)

Note: pcs - packaging; INN - international non-proprietary name; Qrt - quarter.

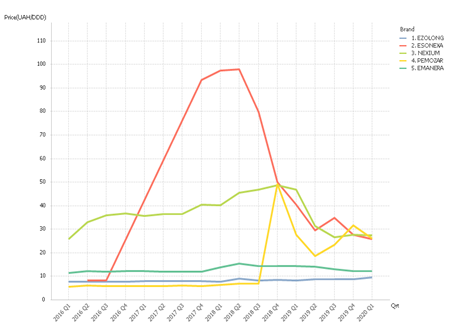

It is also possible that the driver of the high growth rate of demand for the esomeprazole group was a significant reduction in the cost of treatment. As can be seen from Fig. 2 during 2018-2019, the average cost of 1 day of treatment with Ezonex decreased almost three times - from UAH 98 per DDD (average recommended daily dose of the drug) to UAH 30 per DDD.

Figure 2: Dynamics of the average cost of 1 day of treatment with esomeprazole medicines of different brands (Ukraine, Q1 2016 - Q1 2020)

Note UAH - hryvnia; DDD - recommended average daily dose; Brand - trade name; Qrt - quarter.

In parallel with the study of the structure of consumption of various PPIs, an analysis of the structure of prescriptions for the treatment of pathology of the gastrointestinal tract by domestic physicians. It should be noted that in the 1st quarter of 2020, the PPI group became the leader in terms of absolute prescriptions among medicines that affect the digestive system and metabolism (Table 7). Of the more than 2 million prescriptions made during the analyzed period, more than 400,000 were in the PPI group, which accounted for 17% of all prescriptions of this therapeutic group of drugs.

Table 7: The structure of prescriptions of medicines that affect the digestive system and metabolism (Ukraine, Q1 2020)

|

ATC 4 |

Number of appointments, pcs |

Share% |

Hospital |

Clinic |

|

In general |

2,406,128 |

100% |

182,130 |

2,223,998 |

|

A02B C Proton pump inhibitors |

408,843 |

17% |

44,164 |

364,679 |

|

A11D B Vitamin B1 in combination with vitamin B6 and / or B12 |

336,294 |

14% |

25,437 |

310,857 |

|

A10B A Biguanides |

320,693 |

13% |

11,568 |

309,125 |

|

A01A D Other topical agents in dentistry |

288,275 |

12% |

11,967 |

276,308 |

|

A16A X Various medicines that affect digestion and metabolism |

234,149 |

10% |

26,384 |

207,764 |

|

A09A A Enzymes |

197,980 |

8% |

12,691 |

185,289 |

|

A07F A Antidiarrheals |

172,606 |

7% |

18,325 |

154,282 |

|

A02B X Other remedies for peptic ulcer and GERD |

152,545 |

6% |

15,304 |

137,241 |

|

A03A A Synthetic anticholinergics |

147,515 |

6% |

12,665 |

134,850 |

|

A10B B Sulfonylurea preparations |

147,228 |

6% |

3,625 |

143,603 |

Because, according to the study, the share of specialists who prescribed PPI to their patients among gastroenterologists was the highest and amounted to 95% (Table 8) of the sample, and also because the share of average monthly PPI appointments per 1 gastroenterologist was the highest according to appointments of the 1st quarter of 2020, it was decided to assess the structure of the PPI extract by molecules and key diagnoses based on appointments of gastroenterologists.

Table 8: Appointment of PPIs by Ukrainian physicians of various specialties (Ukraine, Q1 2020)

|

Specialty |

Number specialists in the sample |

Number of appointments for the analyzed period |

The share of physicians in the sample who announced the appointment of PPIs for the analyzed period (%) |

The average number of PPIs per 1 doctor per month |

Assignment share (%) |

|

Gastroenterologists |

847 |

121,224 |

95% |

50 |

56% |

|

Cardiologists |

2,660 |

8,520 |

15% |

7 |

8% |

|

Neurologists |

3,212 |

15,729 |

17% |

10 |

11% |

|

Otolaryngologists |

1,732 |

9 |

0% |

0 |

0% |

|

Pediatricians |

4,058 |

4,041 |

9% |

4 |

4% |

|

Psychiatrists |

1,288 |

19 |

2% |

0 |

0% |

|

Therapists / Family doctors |

8,660 |

258,934 |

69% |

14 |

16% |

|

Endocrinologists |

977 |

367 |

4% |

3 |

3% |

As can be seen from Table 9, a total of 121,224 prescriptions of PPIs were made by a sample of gastroenterologists during the 1st quarter of 2020. It is important to note that as of the 1st quarter of 2020, the number of prescriptions for esomeprazole exceeded the number of prescriptions for such widely used molecules as omeprazole and rabeprazole. Esomeprazole took the 2nd position with a share of 19%, and the leader in terms of purpose was the pantoprazole molecule.

Table 9: The structure of appointments of different PPI molecules by gastroenterologists (Ukraine, Q1 2020)

|

INN |

Number of appointments, pcs |

Share% |

Hospital |

Clinic |

|

In general |

121,224 |

100% |

18,376 |

102,849 |

|

PANTOPRAZOLE |

64,568 |

53% |

8,795 |

55,773 |

|

ESOMEPRAZOLE |

22,712 |

19% |

4,047 |

18,665 |

|

RABEPRAZOLE |

14,536 |

12% |

1,490 |

13,046 |

|

OMEPRAZOLE |

9,704 |

8% |

2,366 |

7,338 |

|

DEXLANSOPRAZOLE |

6,234 |

5% |

1,585 |

4,649 |

|

DOMPERIDONE + OMEPRAZOLE |

2,658 |

2% |

92 |

2,566 |

|

LANSOPRAZOLE |

811 |

1% |

0 |

811 |

To understand how highly specialists assess the functional spectrum of capabilities of the esomeprazole molecule, an analysis of clinical diagnoses was performed, according to which esomeprazole was prescribed by gastroenterologists. In general, the appointment of esomeprazole was noted by gastroenterologists for 27 diagnoses according to the ICD-10 classification. The most common diagnoses in which doctors decided to prescribe esomeprazole to the patient were: chronic pancreatitis (34.39%), esophagitis (8.33%) and gastroduodenitis (8.29%), which are shown in table 10.

Table 10: List of the most common diagnoses for which esomeprazole was prescribed (Ukraine, Q1 2020)

|

Diagnosis of ICD 10 |

Number of appointments, pcs |

Share% |

Hospital |

Clinic |

|

In general |

22,712 |

100% |

4,047 |

18,665 |

|

K86.1 Other chronic pancreatitis |

7,811 |

34.39% |

1,485 |

6,326 |

|

K20 Esophagitis |

1,892 |

8.33% |

0 |

1,892 |

|

K29.9 Gastroduodenitis unspecified |

1,883 |

8.29% |

261 |

1,622 |

|

K29.5 Chronic gastritis unspecified |

1,797 |

7.91% |

0 |

1,797 |

|

K21.0 Gastroesophageal reflux with esophagitis |

1,451 |

6.39% |

498 |

953 |

|

K21.9 Gastroesophageal reflux without esophagitis |

1,232 |

5.43% |

323 |

909 |

|

K29.1 Other acute gastritis |

1,170 |

5.15% |

0 |

1,170 |

|

K25.9 Not specified as acute or chronic peptic ulcer without bleeding and perforation |

844 |

3.71% |

0 |

844 |

|

K29.7 Gastritis unspecified |

777 |

3.42% |

0 |

777 |

|

K22.0 Achalasia of the cardiac part of the esophagus |

680 |

2.99% |

0 |

680 |

|

K26.7 Chronic duodenal ulcer without bleeding or perforation |

498 |

2.19% |

415 |

83 |

|

K30 Dyspepsia |

479 |

2.11% |

0 |

479 |

Note: ICD 10 is the 10th revision of the International Classification of Diseases

Conclusions:

References